Energy - Climate

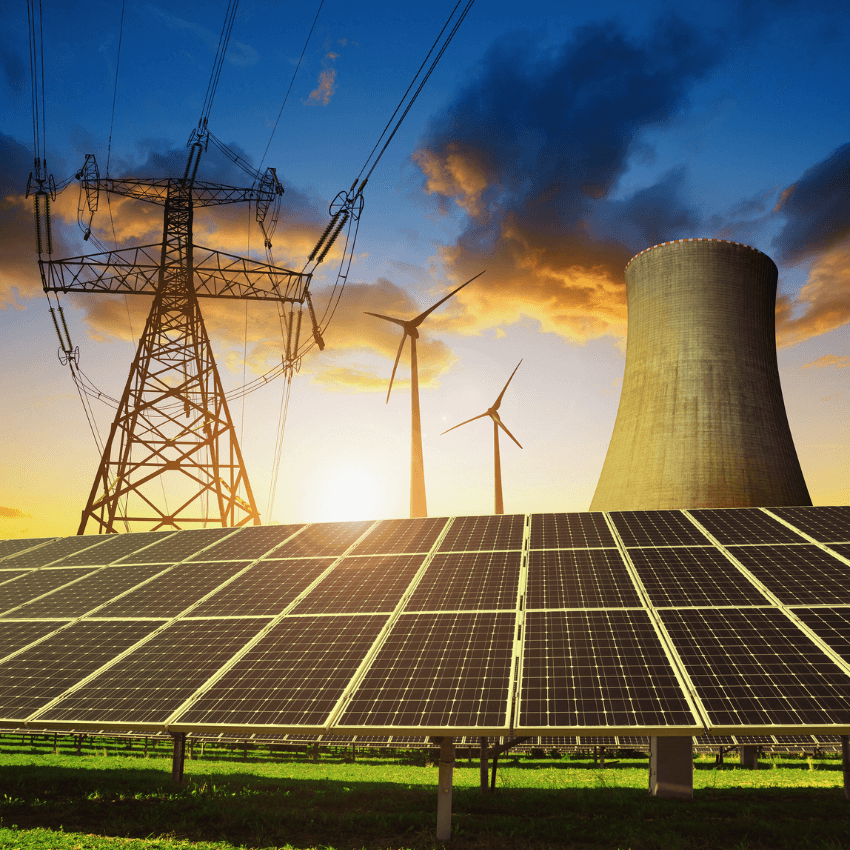

In the face of the climate emergency and geopolitical confrontations, how can we reconcile security of supply, competitiveness, accessibility, decarbonization and acceptability? What policies are needed?

Related Subjects

Coal Exit or Coal Expansion? A Review of Coal Market Trends and Policies in 2017

Coal in the power sector is the principal focus of climate-related policies due to its high carbon intensity, making CO2 emissions from coal a leading contributor to climate change.

Oil Exploration and Production in Africa since 2014. Evolution of the Key Players and their Strategies

The fall in oil prices, which began in fall 2014, had a significant influence on the strategies of the key players in the oil industry in Africa.

Wind of change as France faces end of era

A few months ago French environment minister Nicolas Hulot took the trip of almost 100m to the top of a wind turbine funded partly by a co-operative of poultry farmers. Back on the ground, he found the right analogy to tell his audience why the country needs plenty more of the same.

More renewables in the European Union? Yes, we can

The European Union is about to adopt new renewable energy targets for 2030. While going beyond the initially-planned 27% is absolutely feasible, the EU strategy can only be credible if it is based on a good mix between performance and effort obligations, and also includes possible review clauses.

China’s National Carbon Market: a Game Changer in the Making?

As 2017 drew to close, China officially approved plans for its long-awaited national Emission Trading Scheme (ETS) and the National Development and Reform Commission (NDRC) outlined some of the implementation details[1]. Though it will be limited to the power sector (and combined heat and power, or CHP) at first, it will nevertheless be the world’s largest carbon market. It is expected to cover 1,700 companies representing approximately 30% of China’s total greenhouse gas (GHG) emissions. China’s CO2 emissions from fuel combustion amounted to approximately 8,796 metric tonnes of CO2 equivalent (MtCO2Eq.) in 2016, and seem to remain stable since 2014, though they appear to increase again in 2017[2]. Shanghai should host the national market exchange, which will be jointly owned by the governments of other provinces while Hubei should host the registry[3].

Trump's Tax Reform and Trade Policy: Renewables Spared, Oil Industry Wins

The energy sector is one where the break between the Trump and Obama administrations is the most pronounced. The three officials in charge, Rick Perry at the Department of Energy (DoE), Scott Pruitt at the Environmental Protection Agency (EPA) and Ryan Zinke at the head of the Department of the Interior (DoI), share the same indifference to the issue of climate change, the same will to encourage oil and gas production in the USA in order to bring an era of American “energy dominance”, the same desire to promote the extraction of “beautiful, clean coal”, to paraphrase President Trumps’s State of the Union address, and the same deep mistrust of renewable energies such as wind and solar.

The Gazprom-Naftogaz Stockholm Arbitration Awards: Time for Settlements and Responsible Behaviour

The signing in January 2009 of the gas supply and transit contracts between Gazprom and Naftogaz marked a turning point in Russian-Ukrainian gas relations: yearly intergovernmental, last minute and non-transparent winter deals were replaced by a predictable, long term commercial relationship.

South Korea's New Electricity Plan. Cosmetic Changes or a Breakthrough for the Climate?

Shortly after his inauguration in May 2017, the President of South Korea, Moon Jae-In, announced a major policy shift away from nuclear and coal power, and toward renewables and gas. This would have meant a complete U-turn from previous policies, considering that nuclear and coal produced 40% and 30% respectively of Korea’s total electricity in 2016.

Renewable Energy in India: Solutions to the Financing Challenge

India has committed to ambitious action on climate change, but financing its renewable energy goals remains a significant challenge.

The Challenge of Urban Mobility. A Case Study of Addis Ababa Light Rail, Ethiopia

In September 2015, Addis Ababa introduced the first Light Rail Transit system (LRT) in sub-Saharan Africa. This tram, a symbol of Ethiopian renewal, was nevertheless barely used by the capital’s residents during the first few months. However, at the time of our research trip in April 2017, access to the tram during rush hour was difficult and the trams were overcrowded.

International Thoughts for the Energy Experts Contribution to the G8

Russia reiventing the Wheel/Governance is not always better governance

Support independent French research

Ifri, a foundation recognized as being of public utility, relies largely on private donors – companies and individuals – to guarantee its sustainability and intellectual independence. Through their funding, donors help maintain the Institute's position among the world's leading think tanks. By benefiting from an internationally recognized network and expertise, donors refine their understanding of geopolitical risk and its consequences on global politics and the economy. In 2024, Ifri will support more than 70 French and foreign companies and organizations.