Towards a New Geopolitics of Energy?

First of all, shale oil is starting to take the same dimension as shale gas in the US. Already 51% of US production comes presently from unconventional gas (shale, tight gas and coal-bed methane), and outlooks predict that the US will produce more gas than Russia by 2020. Oil imports have already diminished from 60 to 45%. As domestic unconventional oil production tends to increase, - it is now around 15% - imports will probably decline even more.

When looking at USA’s neighbor, Canada, patterns have been taking an unexpected turn as well: Canada is leader in oil sands production, with forecasts exceeding 3.5 MM bpd in 2025. As Canadian production is directed to the US WTI hub (creating bottlenecks) prices have noticeably fallen, leading to spreads between the Brent and the WTI prices of around 10-12 dollars per bbl, with possible worldwide impacts (refineries, petrochemical industry…).

Besides North America, a great potential in unconventional resources is expected in Asia (mostly China), South America (especially Argentina), Africa (South Africa and Algeria) and Europe (Poland, Ukraine, France and deep-water discoveries in the East Mediterranean Sea). In OPEC countries, new techniques can be applied to old fields to improve their output, for instance in Venezuela, which became the world’s largest holder of proven oil reserves (296.5 billion barrels versus 265.4 for Saudi Arabia - BP, Statistical Review of World Energy 2012). In addition, Eastern Africa and Brazil are coming under the reflectors for their important discoveries in deep water (think of Eni’s discoveries in Mozambique, with potential gas reserves between 1,330 and 1,471 billion cubic meters, Bcm).

China has put in place an ambitious target of producing 60 Bcm of gas by 2020, as its shale gas resources are considered to be as high as in the US. It started investing abroad (mainly in the US) and now it allows joint ventures for exploration and production on its soil.

But China is also at the center of the explosion of Asian demand for hydrocarbons. With a steady growth in middle class population, China and India are eager for resources to satisfy their demand. A new energy axis is then appearing, with China and India interested in the hydrocarbons produced in Middle East and Africa.

If North America tends to become self-sufficient, the resources game will now be played between China, India and Europe on one side, Middle-East, South America (Venezuela, Brazil, to a lesser extent Argentina) and Africa on the other side. In the medium-term, though, as unconventional oil production is still at its beginnings, the Middle East region will still play a significant role in oil production.

Also available in:

Regions and themes

Share

Related centers and programs

Discover our other research centers and programsFind out more

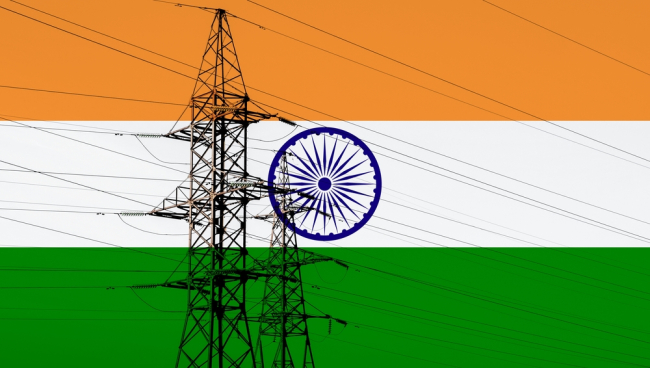

Discover all our analysesIndia’s Broken Power Economics : Addressing DISCOM Challenges

India’s electricity demand is rising at an impressive annual rate of 9%. From 2014 to 2023, the country’s gross domestic product (GDP) surged from 1.95 trillion dollars ($) to $3.2 trillion (constant 2015 US$), and the nation is poised to maintain this upward trajectory, with projected growth rates exceeding 7% in 2024 and 2025. Correspondingly, peak power demand has soared from 136 gigawatts (GW) in 2014 to 243 GW in 2024, positioning India as the world’s third-largest energy consumer. In the past decade, the country has increased its power generation capacity by a remarkable 190 GW, pushing its total installed capacity beyond 400 GW.

The Troubled Reorganization of Critical Raw Materials Value Chains: An Assessment of European De-risking Policies

With the demand for critical raw materials set to, at a minimum, double by 2030 in the context of the current energy transition policies, the concentration of critical raw materials (CRM) supplies and, even more, of refining capacities in a handful of countries has become one of the paramount issues in international, bilateral and national discussions. China’s dominant position and successive export controls on critical raw materials (lately, germanium, gallium, rare earths processing technology, graphite, antimony) point to a trend of weaponizing critical dependencies.

The Aluminum Value Chain: A Key Component of Europe’s Strategic Autonomy and Carbon Neutrality

The United States of America (US), Canada and the European Union (EU) all now consider aluminum as strategic. This metal is indeed increasingly used, especially for the energy transition, be it for electric vehicles (EVs), electricity grids, wind turbines or solar panels.

The EU Green Deal External Impacts: Views from China, India, South Africa, Türkiye and the United States

Ahead of June 2024 European elections and against the backdrop of growing geopolitical and geoeconomic frictions, if not tensions, between the EU and some of its largest trade partners, not least based on the external impacts of the European Green Deal (EGD), Ifri chose to collect views and analyses from leading experts from China, India, South Africa, Türkiye and the United States of America (US) on how they assess bilateral relations in the field of energy and climate, and what issues and opportunities they envisage going forward.