Center for Energy & Climate

Ifri's Energy and Climate Center carries out activities and research on the geopolitical and geoeconomic issues of energy transitions such as energy security, competitiveness, control of value chains, and acceptability. Specialized in the study of European energy/climate policies as well as energy markets in Europe and around the world, its work also focuses on the energy and climate strategies of major powers such as the United States, China or India. It offers recognized expertise, enriched by international collaborations and events, particularly in Paris and Brussels.

Read more

Director, Center for Energy & Climate, Ifri

Publications

See all our interventions

Flagship Publications

Titre Bloc Axe

Research Areas

See all our interventions

Titre Axe de recherche

Geopolitics of Fossil Fuels

The Geopolitics of Fossil Fuels research axis within Ifri's Center for Energy and Climate deals with global geopolitical trends of the oil, gas and coal sectors, with a focus on short and longer term trends in demand and supply.

Titre Axe de recherche

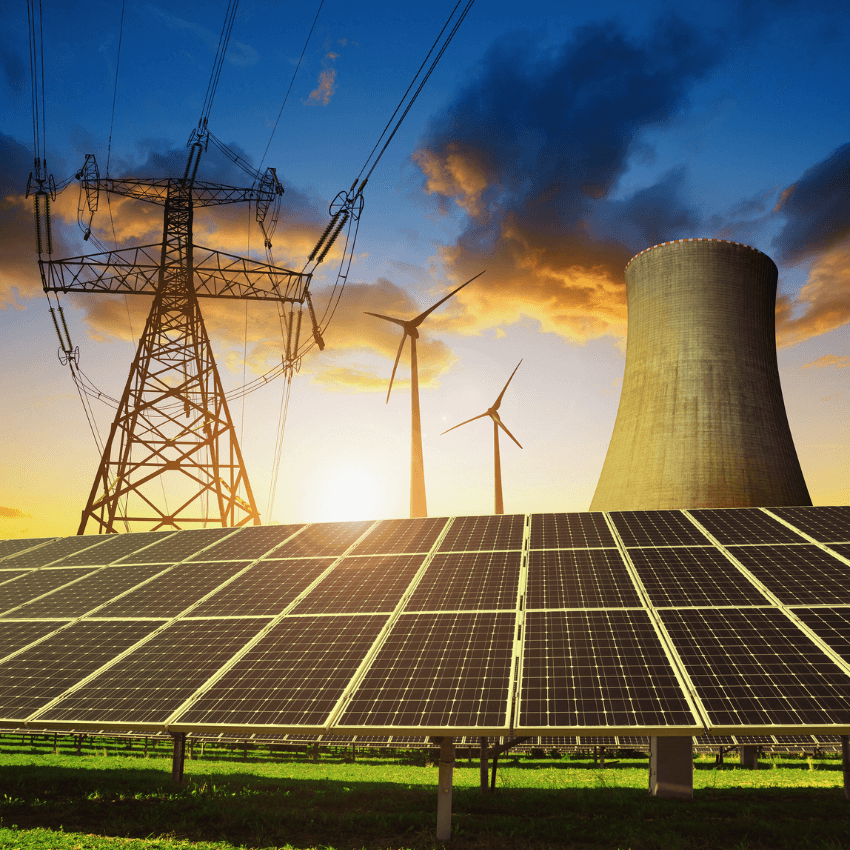

Major Stakes of the Electricity Sector

The Major Stakes of the Electricity Sector research axis within Ifri's Center for Energy & Climate focuses on the economic and geopolitic transformation of the electricity sector, at French, European and global levels. A specific attention is devoted to the future of the nuclear industry and the strong development of renewable energy sources.

Titre Axe de recherche

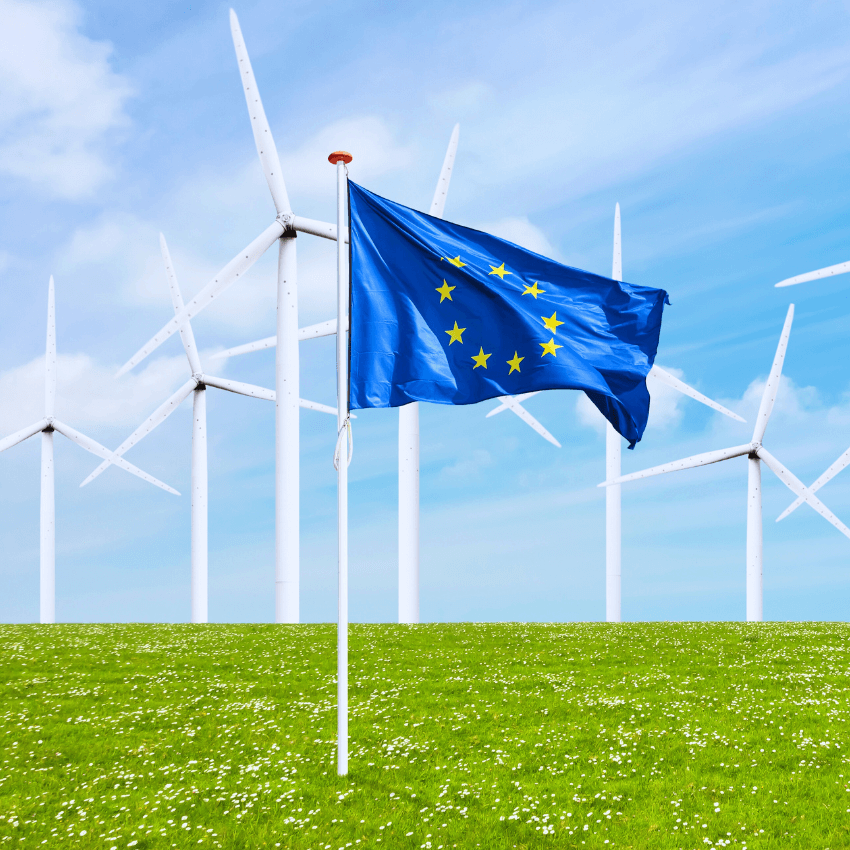

European Energy Policy

The European Energy Policy research axis within Ifri's Center for Energy & Climate examines the major policy regulatory issues of the European internal and external energy policies, with a focus on the integration of energy markets and the deployment of low-carbon technologies.

Titre Axe de recherche

Climate Policies and Energy Transition

The Climate Policies & Energy Transition research axis within Ifri's Center for Energy & Climate deals with the climate change policies adopted at national levels, as well as the positions of the main emitting countries in the international climate negotiations. In particular, this area focuses on the implementation of the Paris Agreement on climate and global efforts to reduce green-house gas emissions to limit the increase of temperature at +1,5° by 2100.

The Team

Our research fellows: Center for Energy & Climate

Publications

Booming Prices on the European Emission Trading System: From Market Oversupply to Carbon Bubble?

Since its creation in 2005, the European emission trading system (EU ETS) has been through several periods of turmoil. With emission allowances (EUA) averaging around 7 euros per ton from 2012 to 2017, European Member States have been trying to remedy the depressed price signals successively through market design reforms at both European level (backloading, market stability reserve) and national level, with the UK introducing a carbon price floor for its domestic power sector in 2013.

Xi Jinping’s Institutional Reforms: Environment over Energy?

During its two sessions (lianghui) in March 2018, the National People’s Congress (NPC) announced China’s most important institutional reforms in the last 30 years. These changes occurred right after Xi Jinping consolidated his power and at a time when stakeholders working in the energy field were expecting more clarity on policy orientations.

Romania: a key player in the Energy Union for the security of natural gas supply?

In 2015, Maroš Šefcovic, Vice President of the European Commission for Energy Union, was writing about Romania as being «at a crossroads - both in strategic and physical terms.

More renewables in the European Union? Yes, we can

The European Union is about to adopt new renewable energy targets for 2030. While going beyond the initially-planned 27% is absolutely feasible, the EU strategy can only be credible if it is based on a good mix between performance and effort obligations, and also includes possible review clauses.

China’s National Carbon Market: a Game Changer in the Making?

As 2017 drew to close, China officially approved plans for its long-awaited national Emission Trading Scheme (ETS) and the National Development and Reform Commission (NDRC) outlined some of the implementation details[1]. Though it will be limited to the power sector (and combined heat and power, or CHP) at first, it will nevertheless be the world’s largest carbon market. It is expected to cover 1,700 companies representing approximately 30% of China’s total greenhouse gas (GHG) emissions. China’s CO2 emissions from fuel combustion amounted to approximately 8,796 metric tonnes of CO2 equivalent (MtCO2Eq.) in 2016, and seem to remain stable since 2014, though they appear to increase again in 2017[2]. Shanghai should host the national market exchange, which will be jointly owned by the governments of other provinces while Hubei should host the registry[3].

Trump's Tax Reform and Trade Policy: Renewables Spared, Oil Industry Wins

The energy sector is one where the break between the Trump and Obama administrations is the most pronounced. The three officials in charge, Rick Perry at the Department of Energy (DoE), Scott Pruitt at the Environmental Protection Agency (EPA) and Ryan Zinke at the head of the Department of the Interior (DoI), share the same indifference to the issue of climate change, the same will to encourage oil and gas production in the USA in order to bring an era of American “energy dominance”, the same desire to promote the extraction of “beautiful, clean coal”, to paraphrase President Trumps’s State of the Union address, and the same deep mistrust of renewable energies such as wind and solar.

The Gazprom-Naftogaz Stockholm Arbitration Awards: Time for Settlements and Responsible Behaviour

The signing in January 2009 of the gas supply and transit contracts between Gazprom and Naftogaz marked a turning point in Russian-Ukrainian gas relations: yearly intergovernmental, last minute and non-transparent winter deals were replaced by a predictable, long term commercial relationship.

South Korea's New Electricity Plan. Cosmetic Changes or a Breakthrough for the Climate?

Shortly after his inauguration in May 2017, the President of South Korea, Moon Jae-In, announced a major policy shift away from nuclear and coal power, and toward renewables and gas. This would have meant a complete U-turn from previous policies, considering that nuclear and coal produced 40% and 30% respectively of Korea’s total electricity in 2016.

The EU Battery Alliance. Can Europe Avoid Technological Dependence?

With the launch of its “battery alliance”, the European Union is finally taking up the industrial battle with Asia and hopes to meet a large share of the surging demand for electrical batteries. Yet, the clock is ticking and the future of battery manufacturing in Europe depends primarily on the strategies that automakers will adopt.

Decarbonizing Germany’s Power Sector: Ending Coal with a Carbon Floor Price?

Germany has a long tradition of climate policy programmes with ambitious greenhouse gas emission reduction targets and comprehensive climate and energy policy packages.

This target-driven policy approach is, however, increasingly facing challenges due to the lack of progress on greenhouse gas emission reductions in key sectors, i.e. the power, the transport and the building sector.

Support independent French research

Ifri, a foundation recognized as being of public utility, relies largely on private donors – companies and individuals – to guarantee its sustainability and intellectual independence. Through their funding, donors help maintain the Institute's position among the world's leading think tanks. By benefiting from an internationally recognized network and expertise, donors refine their understanding of geopolitical risk and its consequences on global politics and the economy. In 2024, Ifri will support more than 70 French and foreign companies and organizations.