European public opinion on China in the age of COVID-19: Differences and common ground across the continent

In September and October 2020, the Sinophone Borderlands project at Palacký University Olomouc conducted a wide-scale survey of public opinion on China in 13 European countries. The polled countries include: Czechia, France, Germany, Hungary, Italy, Latvia, Poland, Russia, Serbia, Slovakia, Spain, Sweden, and the United Kingdom. Here, we present the basic findings of the survey, which are a result of a joint analysis of the survey data by the Central European Institute of Asian Studies (CEIAS) and Sinophone Borderlands.

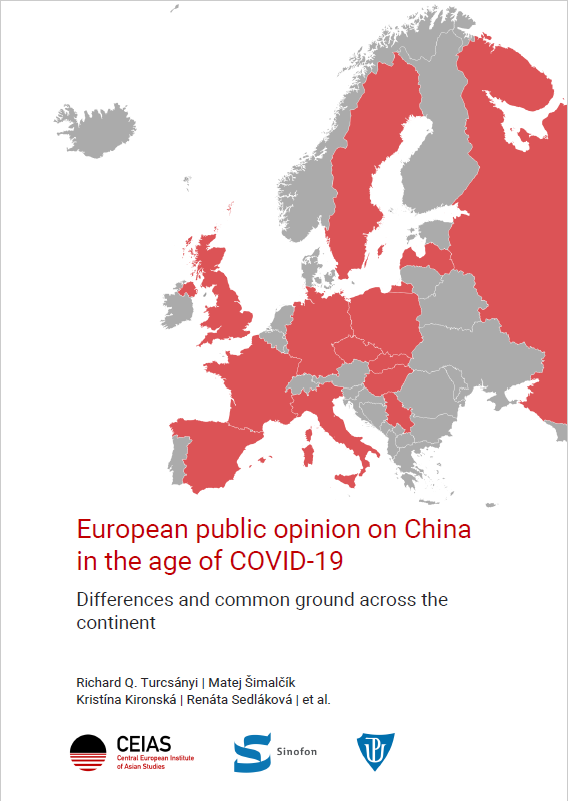

Overall, views of China in the surveyed countries are predominantly negative, with respondents in 10 out of 13 countries reporting significantly more negative than positive views. Populations in Western and Northern Europe tend to have the most negative views, Eastern Europe holds positive views, and Southern and Central Europe find themselves in between, while still being predominantly negative.

Swedish respondents reported the most negative feelings, with altogether 60% holding very negative or negative feelings of China, and only 12% reporting positive or very positive feelings of China (the remaining 28% seeing China neutrally). Countries with decisively negative popular views include Germany, France, the UK, and the Czech Republic. On the opposite end, Russian and Serbian respondents have the most positive view of China with almost 60% of respondents having very positive or positive views. The only EU country having a predominantly positive view of China is Latvia, where about 43% of respondents had positive views of China, compared to 28% having negative views. The four Visegrad countries (Poland, Hungary, Slovakia, and the Czech Republic) end up somewhere in the middle of the spectrum, although with prevailingly negative sentiments.

The picture is similar when looking at how respondents themselves evaluate the change in their views of China within the last three years. The British report the most significant worsening of the view of China with more than two-thirds of respondents declaring their views of China worsened and only about 6% saying their views improved. Other countries where the views of China significantly worsened are Sweden, France, and Germany. Serbia is by far the country with the most significantly improved image of China - almost half of the respondents found their view of China getting better, compared to 16% who found their views worsening. Russia and Latvia also have more respondents reporting their views of China improving rather than worsening.

When looking at various aspects of interactions, only trade with China is perceived predominantly positive in most countries - exceptions being France, the UK, and Sweden who lean slightly negative. In comparison, Chinese investments are perceived somewhat more negatively, with only a minority of countries leaning to the positive - such as Serbia, Russia, Latvia, and Poland. Chinese investments are the most negatively perceived by respondents in Sweden, France, and Germany. Similarly, the Belt and Road Initiative is perceived somewhat positively in Serbia, Russia, Latvia, Italy, and Poland, while the remaining countries lean towards negative perceptions.

The most negatively perceived issues are China’s impact on the global environment and China’s effect on democracy in other countries, where respondents in all thirteen countries have decisively negative perceptions.

This suggests that even in countries where there is a generally positive attitude towards China, there is a recognition of the downsides. Moreover, it emphasizes that even after four years of the Trump administration during which China attempted to present itself as a responsible power in terms of global environment protection, European respondents still did not recognize it as such. Overall, China’s soft power in Europe still seems to be very limited - and the limitations appear even more visible when scratching beneath the surface.

Limitations of China’s soft power are again visible when looking at how little trust China enjoys among the respondents compared to the EU, U.S., and Russia. In most countries, the EU and the U.S. are by far the most trusted actors. Only Russian and Serbian respondents trust China more than they trust the EU and the U.S.

In the remaining 11 countries, the EU is trusted the most, far ahead of the U.S., with Russia, and China last. There are only slight variations in this picture, such as the UK where the trust to the U.S. comes close to the EU, reflecting their traditional transatlantic directions and also skepticism among parts of the population towards the EU. Other countries where there is relatively high trust in the U.S. are Hungary, Poland, and Italy. In Slovakia and Latvia, the trust of the EU is high (Latvia has the highest trust towards the EU from among all the countries), while the trust of the U.S. is lower than that of Russia.

The specific issue of 5G networks reflects these policy preferences, as respondents show preferences for cooperating with companies of some countries while rejecting others. In most countries, respondents decisively favor cooperation with companies from the EU, followed by those from Japan and the U.S. Perhaps interestingly, fewest respondents wanted to cooperate with South Korea, including in Italy, Spain, Hungary, or Poland. Chinese companies belong among the least favored to cooperate with on the construction of the 5G networks, especially in Sweden, the Czech Republic, the UK, France, and Germany.

The full report with charts is available to download below, as well as on the CEIAS website.

Available in:

Regions and themes

ISBN / ISSN

Share

Download the full analysis

This page contains only a summary of our work. If you would like to have access to all the information from our research on the subject, you can download the full version in PDF format.

European public opinion on China in the age of COVID-19: Differences and common ground across the continent

Related centers and programs

Discover our other research centers and programsFind out more

Discover all our analysesRussia's Asia Strategy: Bolstering the Eagle's Eastern Wing

Among Russia’s strategic priorities, Asia traditionally played a secondary role compared to the West. In the mid-1990s, then Foreign Minister Yevgeny Primakov initiated a rapprochement with China and India. Then, in 2014, deteriorating relations between Russia and the West prompted Moscow to begin its “great pivot to the East”.

Kazakhstan After the Double Shock of 2022: Political, Economic and Military Consequences

The year 2022 represented a dual shock for Kazakhstan. In January, the country faced its most severe political crisis since independence, followed in February by Russia’s full-scale invasion of Ukraine, which cast uncertainty over the borders of post-Soviet states. These consecutive crises profoundly shaped Kazakhstan’s domestic and foreign policy.

How the Russian Army Changed its Concept of War, 1993-2022

The traditional and high-intensity war that has occurred in Ukraine since Russia decided to invade raises a key issue: did post-soviet Russian strategic thought really prepare Russia for waging this war?

Russia's Nuclear Deterrence Put to the Test by the War in Ukraine

From the outset of its “special military operation” (SVO) against Ukraine on February 24, 2022, Russia, which possesses one of the world’s largest nuclear arsenals, has adopted aggressive deterrence measures and a resolutely menacing rhetorical stance.